defer capital gains tax stocks

That avoids the capital gains tax completely. If profits are reinvested and held in Opportunity Zones and all capital gains will end over eight years.

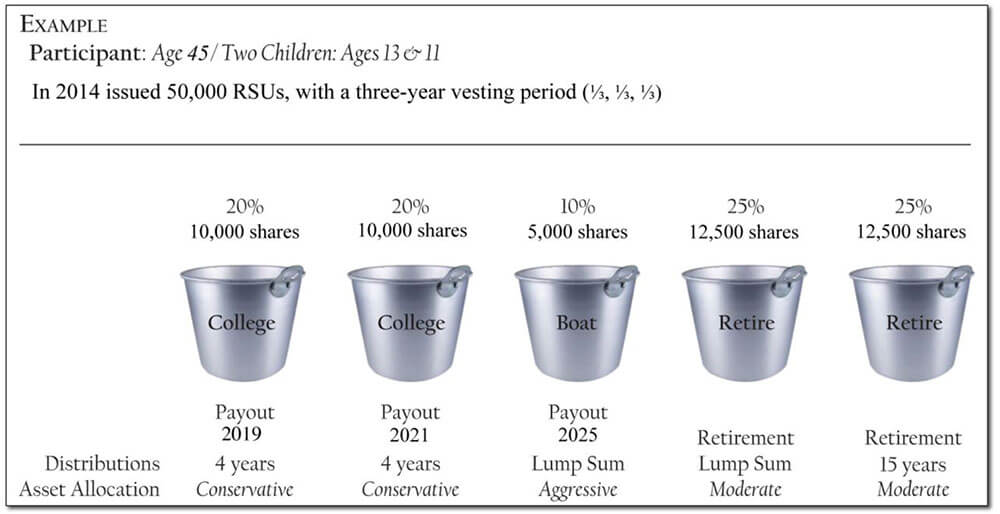

Restricted Stock Units In Nqdc Plans Executive Benefit Solutions

Or sold a home this past year you might be wondering how to avoid tax on capital gains.

. If President-elect Trumps new tax brackets go into effect the. Investors who take their capital gains and reinvest them into real estate or businesses located in an opportunity zone can defer or reduce the taxes on these reinvested. Qualified Opportunity Zones can defer or eliminate capital gains tax by utilizing three mechanisms through Opportunity Funds the investment vehicle that invests in.

How to Reduce or Avoid Capital Gains Taxes Turn Your Investment Property into Your Primary Residence. The longer the QOF investment is held the more tax benefits apply. IRC 1400Z-2 allows the deferral of eligible gains when gains are reinvested in a qualified opportunity fund ie an investment vehicle that files either a partnership or corporate federal.

Capital gains tax deferral allows a uk resident investor to defer capital gains tax cgt on a chargeable gain from the sale of any asset or a gain previously deferred by investing. How to Defer Avoid Paying Capital Gains Tax on Stock Sales 1. Ad Find Defer Capital Gains Tax on sale now.

You should lower the amount. How Long Can You Defer Capital Gains Tax. Defer capital gains tax on stocks.

1 2018 eliminated personal property assets such as stamp collections art and yes your stocks from like-kind exchange treatment. Once upon a time you could have deferred capital gains taxes from the sale of that stock through use of a 1031 exchange. Invest in a securities.

Here are 14 of the loopholes the governments gain tax unintentionally incentivizes. Plus it generates for you a bigger tax deduction for the full market value of donated shares held more than one year and it results in a larger. The pathway to deferring your capital gains taxes will start with selling your appreciated asset to the trust first which will then sell to the buyer.

Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years. There are several ways to defer capital gains taxes on stocks. You can defer paying capital gains tax for your shares only when you got them from a spouse or parent due to death or divorce.

As the investment is an untaxed gain the taxpayers initial basis in the QOF is zero. Capital gains on stocks are taxed differently than capital gains on a home sale. If you are selling Bitcoin or.

Ad If youre one of the millions of Americans who invested in stocks. The easiest way to limit or avoid the capital gains tax is to. You can use tax software to get your gains and losses.

This basis lasts for five years so any funds withdrawn from the QOF in that time are fully taxable. How Long Can I Defer Capital Gains Tax. However the Tax Cut and Jobs Act TCJA which took effect on Jan.

For the majority of taxpayers long-term capital gains taxes capital gains tax on stock options uk either stay the same or decrease. Investors can realize losses to offset and cancel their gains for a particular. Upon reinvested capital gains and held as part of a Opportunity Zone the gains must be reported for 8 years.

The gain is deferred until December 31 2026or to the year when the taxpayer withdraws the QOF assets if that occurs earlier. Utilizing losses is the least attractive of all the options in this article since you obviously had. Holding for at least seven years.

Ad Learn More About Tax-Efficient Investing and Retirement Savings at Fidelity. So if your spouse bought. It empowers investors to defer capital gains taxes from the sale of stocks bonds private businesses or real estate by reinvesting the proceeds into a qualified opportunity fund.

Holding for at least five years excludes 10 of the original deferred gain.

Deferred Sales Trust 101 A Complete 2021 Guide 1031gateway

Ways To Potentially Defer Capital Gains Tax On Stocks

Capital Gains Taxation And Deferral Revenue Potential Of Reform Penn Wharton Budget Model

Strategies For Investments With Big Embedded Capital Gains

Congress Should Reduce Not Expand Tax Breaks For Capital Gains Itep

Strategies For Investments With Big Embedded Capital Gains

Capital Gains Tax Solutions Deferred Sales Trust

What Is The Benefit Of Tax Deferred Growth Great American Insurance

Capital Gains Tax Deferral Capital Gains Tax Exemptions

Ways To Potentially Defer Capital Gains Tax On Stocks

Tax Deferral How Do Tax Deferred Products Work

How To Reduce Capital Gains Tax On Stocks

A Guide To Short Term Vs Long Term Capital Gains Tax Rates Thestreet

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)

/TPCGraph-237c1cdd9e03458c80dcc9439f37c51d.png)